Community News

Here is what’s happening in our greater community.

2024 Community Powered Scholarship Winners

Ethan Padillo will be graduating from William Penn High School where he was in the Marching Band, Jazz Band, Indoor Percussion, and Science Olympiad Program. Ethan plans to study Electrical Engineering at the University of Delaware.

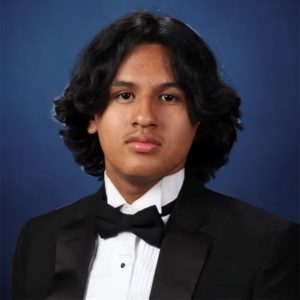

Aarush Goyal is graduating from Appoquinimink High School where he was on the cross country and tennis team in high school. He will major in computer science at the University of Delaware Honors College.

Ryan Mahoney is graduating from The Delaware Military Academy where he earned both the DMA Pride and Seahawk awards. He will attend Williamson College of the Trades to study Landscape Construction and Management.

Help Grow Our Community and Get Rewarded!

Refer-a-Friend Promotion

When you bring other people into the Community Powered Federal Credit Union family, you can win cash or prizes! With our Refer-a-Friend Promotion, you have the chance to earn cash or merchandise by referring family, friends, and co-workers to the Credit Union. All they have to do is open both a Checking and Savings Account* and you get your pick of rewards. The more friends you refer, the more you can win!

Ways to earn prizes:

2 Referrals = $100 OR Apple AirPods®**

3-9 Referrals = $50/per referral

10 Referrals = iPad Mini®**

11+ Referrals = $50/per referral

*New members must complete New Member Referral Bonus forms when opening their account. See credit union for more details.

**Apple is not a participant in or sponsor of this promotion. In the event that Apple AirPods are not in stock please allow up to 30 days to receive the prize.

Bauer 5-Star Rating

Community Powered Federal Credit Union has been awarded the coveted BauerFinancial * 5-Star rating! A 5-Star Rating is categorized as Superior and BauerFinancial recommends our institution. “Bauer rates credit unions based on their overall financial condition,” reports Karen Dorway, president of the rating firm, “and has been doing so for over 40 years. Having a common bond or bonds with the membership, the employees of credit unions, like Community Powered Federal Credit Union, feel a kinship and have a desire to see members grow and thrive,” continues Dorway. “Members of Community Powered Federal Credit Union probably already know this. They have the privilege of belonging to a credit union that sticks to common-sense values with members in mind. It’s important to let those who might not be aware, know that they have the strength of a 5-Star credit union right in their midst.”

Bauer uses the same strict guidelines to rate all banks and all credit unions and makes those ratings available to everyone on their website. BauerFinancial is completely independent and doesn’t get paid to rate an institution, nor can any institution avoid being rated.

This practice has earned the respect of regulators, bankers, and consumers across the United States. They have been analyzing and reporting on the industry since 1983.

Read the full press release

Financial scams can happen to anyone. However, scammers often single out older and retired individuals due to their regular income and potentially substantial savings. In this article, we’ll explore some common scams and provide tips on how to protect yourself and your savings from these schemes.

Phishing scams are emails or text messages designed to trick you into revealing personal information, such as passwords, Social Security numbers, or credit card details. Scammers will often pose as trusted institutions, like banks or government agencies in order to win your trust.

- Always verify the source of an email or message. Legitimate organizations won’t ask for sensitive information through email.

- If you are on a desktop, hover your mouse pointer over links in emails to see the actual web address and make sure it matches the official website of the supposed sender.

- Regularly update your computer’s anti-virus and anti-malware software to help detect phishing attempts.

Tech support scams start when scammers call you, claiming to be from a tech company, and implying that there’s a problem with your computer. They will often ask you to install software so they can remotely access your computer. If they obtain access, they can steal your personal information or install malware.

- Never give out your personal information over the phone to someone you don’t know.

- If you receive a call from someone claiming to be from a tech company, hang up and call the company directly at the number listed on their website.

Impersonation scams rely on manipulating individuals into revealing confidential information or making payments. Scammers may impersonate family members, friends, law enforcement officers, or government employees.

- If someone contacts you asking for money or personal information, independently verify their identity. If the message is supposedly from a friend or family member, contact that person using contact info you already have, not those provided in the message.

- Always ask for identification if someone claims to be an official. Legitimate officials will provide it.

- Scammers often use emotional stories to elicit sympathy and prompt hasty decisions. Take your time to consider before acting.

Impersonation scams rely on manipulating individuals into revealing confidential information or making payments. Scammers may impersonate family members, friends, law enforcement officers, or government employees.

- Do not provide any personal information until you can verify the debt is legitimate.

Investment scams promise a potentially lucrative deal with high returns and little to no risk. These types of scams prey on individuals’ desire to grow their savings.

- Investigate any investment opportunity thoroughly. Verify the legitimacy of the company and check for complaints with the Securities and Exchange Commission (SEC) or your local regulatory body.

- Consult with a certified financial advisor before making any significant investments.

In lottery or prize scams, scammers will claim you’ve won a prize, but before you can be rewarded, they require a fee or personal information.

- If you didn’t enter a contest or lottery, it’s unlikely you’ve won anything.

- Legitimate winnings shouldn’t require upfront fees. Avoid sending money or personal information.

In charity scams, scammers will often pose as a real charity, or set up fake charities in the name of popular causes, such as cancer research or disaster relief. These scams often pop up before the holidays as well as after newsworthy natural disasters and emergencies.

- Look for details about the charity, including physical address and contact number.

- You can verify a charity’s legitimacy through their official website or a reputable third-party source.

Our semi-annual newsletters are available in PDF format. Please visit Adobe’s website for more information on the PDF format and to download the latest version of Adobe Reader